Understanding Credit.

What Makes Up Your Score?

Credit scores range anywhere from 350-850 and are impacted by a range of factors.

Your number is determined by five combined factors to make up your personal score. Yes, your credit score is an important element to your home buying process, but even if your score is lower than desired, don’t give up! At Summit Funding, Inc., we have a team of knowledgeable loan officers who will work with you on your credit strengths and guide you through any weaknesses. Your new home is the ultimate finish line and we want to cross it with you.

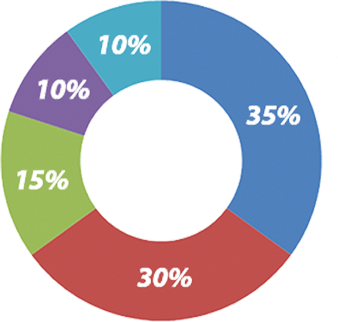

10%

Types of Credit

This looks at what types of credit you have.

10%

New Credit

New applications for credit might cause you to be risky and lower your score.

15%

Length of History

How long your accounts have been open. If you are going to close an account, DO NOT close the oldest.

30%

Debt Utilization

How active EACH of your accounts are will affect this portion of your score.

35%

Payment History

Making sure that you have your payments in full and on time.